Office Hours

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Matthew Rowsey

Rowsey Ins and Fin Svcs Inc

Office Hours

After Hours by Appointment

Address

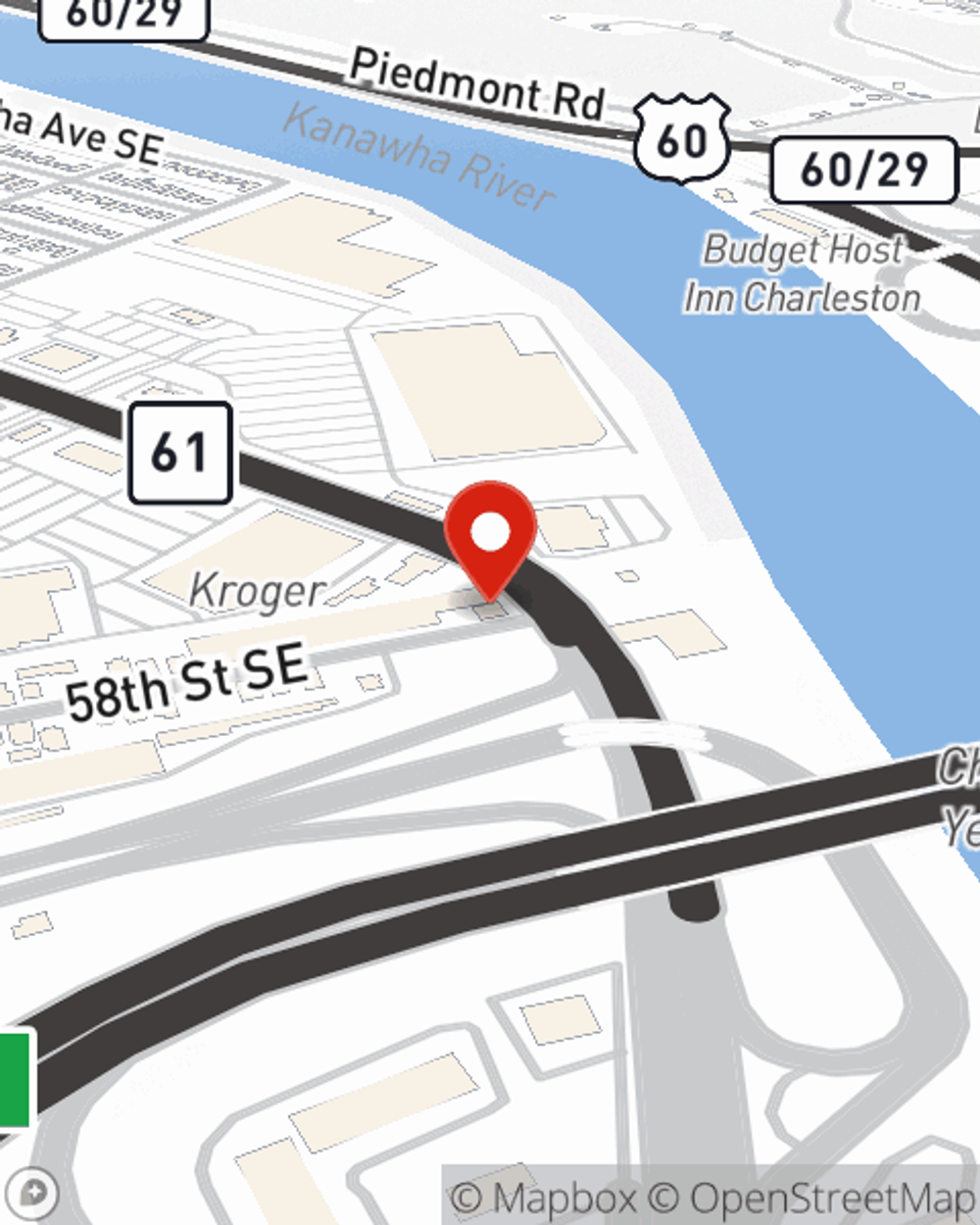

Charleston, WV 25304-2801

across the street from Fujiyama

Office Hours

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Simple Insights®

How do 529 plans work?

How do 529 plans work?

Learn more about 529 education savings plans that are designed to help families save for future education costs.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Basement storage ideas

Basement storage ideas

Finished and unfinished basement storage can be tricky. Consider these tips to help keep the right things in your home's lower level.

Viewing team member 1 of 5

Patti Burkhart

Account Manager

License #20513225

Patti has been with The Rowsey Agency in Charleston, WV since October of 2022. She runs the day to day activities of the team, insurance purchases, insurance services, Auto, Home, & any other type of insurance we offer. She retired from the West Virginia Offices of the Insurance Commissioner. She spent 27 years working for the state. Patti currently lives in Diamond, WV.

Viewing team member 2 of 5

Emily Ripley

Office Manager

License #17679371

Emily has been with The Rowsey Agency in Charleston, WV since July of 2023. She has been with State Farm since 2015. She recently relocated to Charleston, WV. Since then she has became the Service manager and runs all the day to day activities of the team, insurance purchases, insurance services, Auto, Home, & any other type of insurance we offer.

Viewing team member 3 of 5

Tyler Bunting

Account Manager

License #21400593

Tyler has been with The Rowsey Agency in Charleston, WV since December of 2024. Tyler has been in the car industry for serval year prior to joining the insurance industry. He provides all administrative services for our Auto, Home, & Life Insurance services. He holds both a Property & Casualty License for the States of West Virginia, Ohio, and Kentucky.

Viewing team member 4 of 5

Nash Vincent

Account Manager

License #21455716

Viewing team member 5 of 5

Preston Hamrick

Account Manager

License #21769718

Charleston - WV Full Time

Charleston - WV Full Time

Charleston - WV Full Time