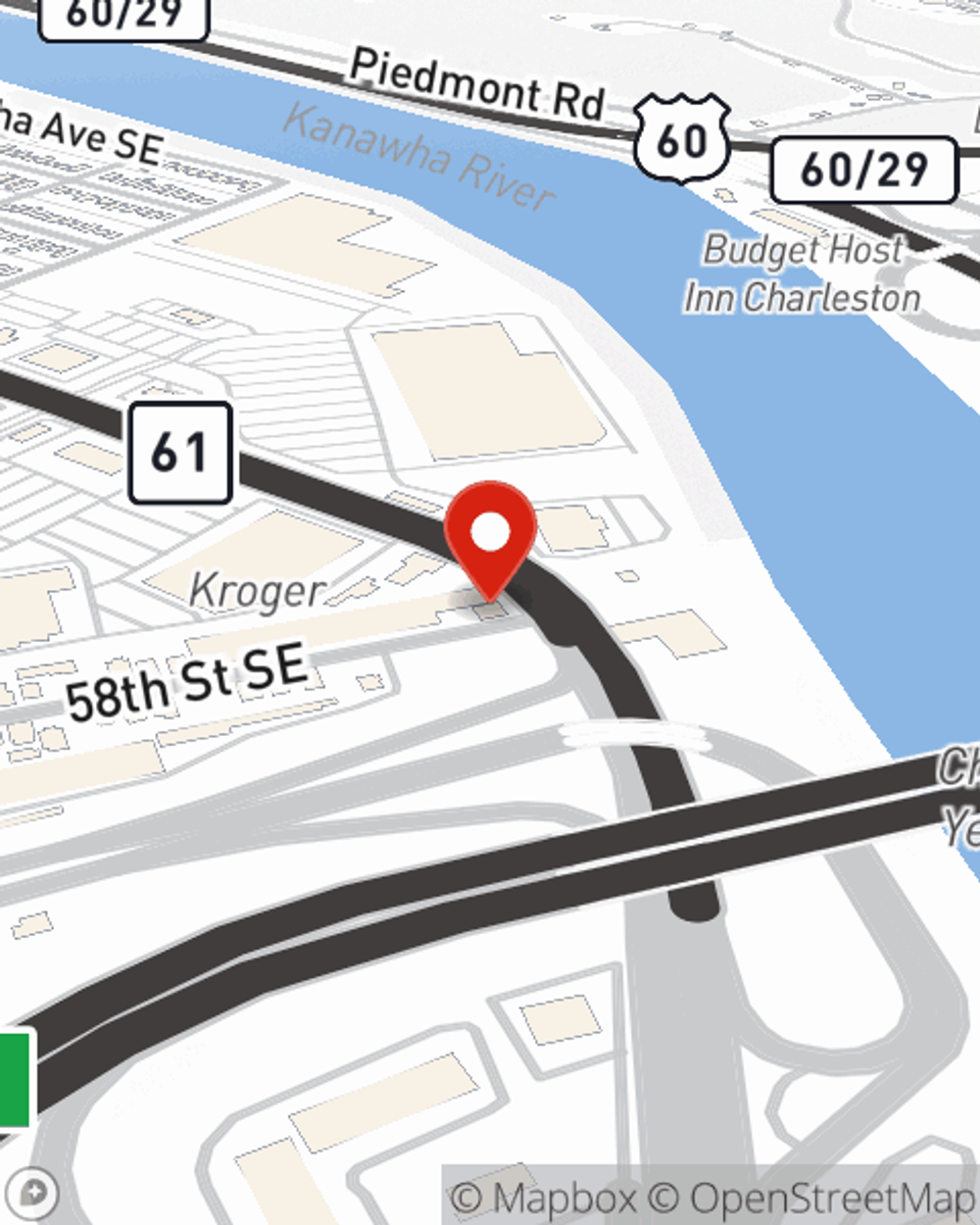

Homeowners Insurance in and around Charleston

If walls could talk, Charleston, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

After a long day, there’s nothing better than coming home. Home is where you recharge, chill out and slow down. It’s where you build a life with the ones you love.

If walls could talk, Charleston, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Safeguard Your Greatest Asset

Matthew Rowsey will help you feel right at home by getting you set up with high-quality insurance that fits your needs. Home insurance from State Farm not only covers the structure of your home, but can also protect precious items like your pictures.

It's always the right move to get coverage with State Farm's homeowners insurance. Then, you won't have to worry about the unpredictable tornado damage to your property. Contact Matthew Rowsey today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Matthew at (304) 925-8000 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Matthew Rowsey

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.